If you earn N200k monthly, you can grow your money to over N570k in investments after a year. The first step would be setting and sticking to a budget. A budget helps you allocate your income to cover your expenses while saving for the future. The 50/30/20 budget is a good starting point, where you use 50% of your income for your needs, 30% for your wants, and 20% for savings and investments. Saving and investing 20% of your income would mean setting aside N40,000 monthly. After 12 months, you’ll have invested N480,000 for a total investment pot of about N570,000+.

Here’s where to put your money to end the year with N570k+ in investments.

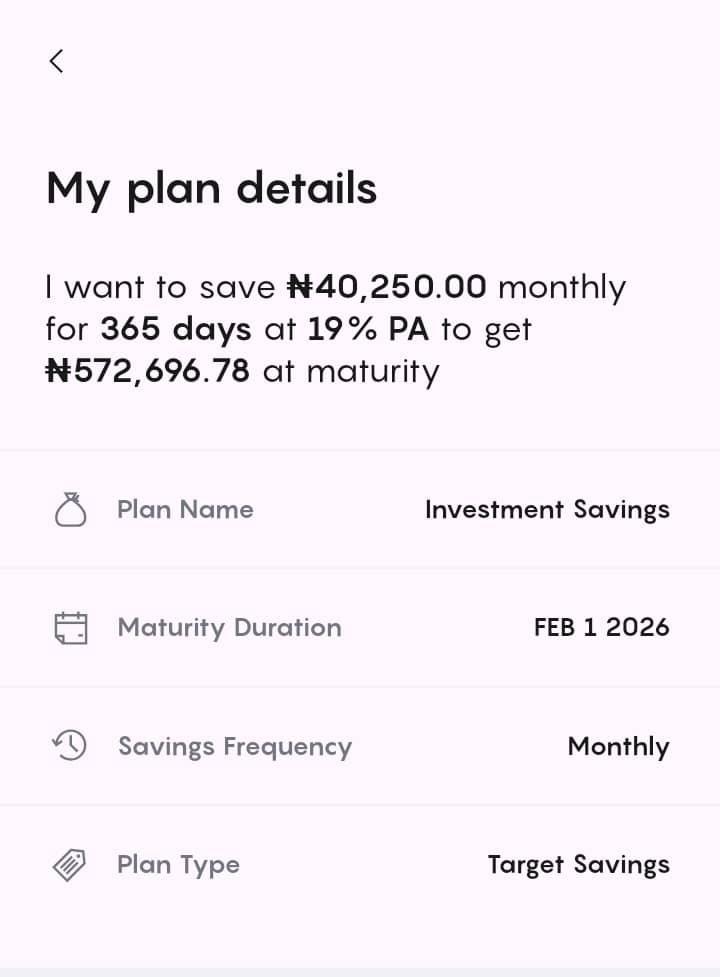

1. Earn up to 19% pa or N570,000 with a High yield Savings Plan

A high-yield savings plan isn’t technically an investment, but it is the ideal place to put your money when you want your savings to grow. These plans are especially great for short-term goals or if you want a safe, low-risk option. Ideally, before getting into other investment options, aim to save three to six months’ worth of living expenses in a high-yield savings plan. Another pro tip if you just started investing is to split your investment allocation in two, keep one half in a high-yield savings plan, and put the other half in other investment options.

Where to open a High-Yield Savings Plan

The best high-yield savings plans have returns that are typically higher than traditional banks. Open a Safebox plan with Moni. A Safe box plan on Moni gives you up to 19% interest per annum.

For example, if you follow our advice to save 20% of your 200k income i.e. N40,000 monthly, you’ll end the year with 480k saved but a total savings pot of about N570k.

Saving on Moni also gives you the added benefit of automating your savings, so you don’t fall off your investing goal.

2. Earn up to 75% pa or N840k with investments in ETFs

ETFs (Exchange Traded Funds) are one of the simplest ways to start investing. Simply put, ETFs are funds that track the performance of a specific index or market sector, offering diversification without requiring you to be an expert. ETFs allow you to invest in multiple assets like stocks, bonds, and commodities. They are cost-efficient and suitable for beginners. The return on an ETF depends on the type of investment, such as stocks or bonds, and the performance of the underlying assets.

Current historical data shows steady growth, especially in ETFs linked to established stock exchange markets around the world. In 2024, ETFs in Nigeria delivered impressive returns with 8 out of the 12 ETFs listed in the Nigerian stock exchange delivering returns that outpaced exceeded inflation. For instance, in 2024 the Meristem Growth ETF had a 75% return, the Meristem Value ETF had 20.68% and the Newgold ETF had 116% return. For you to earn a N840k return on investing with ETFs, you’d have to invest N40k monthly at the rate of 75% pa. or higher.

How to invest in ETFs in Nigeria

Open a Meritrade account where you can take advantage of Meristem‘s different ETFs investment options.

3. Earn up to 8% per annum or around N570k+ savings in Dollars.

Another option to diversify your investment portfolio is saving in USD. By saving in a relatively stable currency like the US dollar, you can hedge against macroeconomic factors like inflation, and currency depreciation.

If you saved 40k/month starting in January 2024 using the mid-market rate each month with a return of 8% per annum, you would have about $348 saved at the end of 2024. At today’s, exchange rate, your N480k savings would have gained around 90k for a total pot of N570k+.

How to Invest

Curious about saving in USD? Reach out to your account manager via the Moni app or send an enquiry email to hello@heymoni.com to learn more.

4. Earn returns of N1m+ in the Nigerian Stock Market

The Nigerian stock market brought in impressive returns in 2024, outperforming food inflation and demonstrating its potential even in tough economic conditions. Looking at data from investing.com, the top-performing stocks include Conoil (283.37%), Eunisell Interlinked (321%), Oando (434.38%) and Sunu Assurances (246.39%).

If you had invested ₦480,000 in these top-performing stocks at the beginning of 2024, your returns would have been as follows:

- Conoil: ₦1,360,176 in profit, bringing your total to ₦1,840,176.

- Eunisell Interlinked: ₦1,540,800 in profit, bringing your total to ₦2,020,800.

- Oando: ₦2,085,024 in profit, bringing your total to ₦2,565,024.

- Sunu Assurances: ₦1,182,672 in profit, bringing your total to ₦1,662,672.

Nigerian stocks remain a good choice for diversification. Banking stocks, which are shares of ownership in a banking company and blue-chip stocks, (shares of well-established companies) are great areas for investment.

How to Invest

The first step to investing in stocks is to pick a reputable platform that lets you buy stocks on the Nigerian Stock Exchange (NSE). Ensure the platform is reliable, user-friendly, and offers tools to support your investment decisions.

5. Earn up to 7.5% to 38% interest with Mutual Funds

Mutual funds pool money from various investors to invest in diverse assets managed by professionals. If you have a low-risk appetite, mutual funds are an excellent option worth considering. These funds come in various types, including money market mutual funds, equity mutual funds, fixed-income mutual funds, dollar mutual funds, and real estate investment trust funds. Mutual funds are professionally managed and allow investors to diversify across multiple financial markets, reducing risk while maximizing potential returns.

In 2024, returns on mutual funds ranged between 7.5% and 38%. Similarly, the Securities and Exchange Commission’s valuation report showed that equity mutual funds achieved an average year-to-date (YTD) gain of 29%, with the Halo Equity Fund recording an impressive 87% YTD return. If you invest ₦480,000 (₦40,000 per month) in mutual funds, your earnings could range between ₦36,000 (at 7.5% interest) and ₦182,400 (at 38% interest) per annum. This means your total balance after a year would be between ₦516,000 and ₦662,400. Mutual funds are a good choice for you if you’re seeking professional management and diversification. However, choosing the right fund type is crucial for achieving a return that beats the current inflation rate.

How to Invest

Some investment platforms allow you to start investing in mutual funds with as little as N5,000. Look into money market funds or balanced funds offered by Nigerian financial institutions such as Stanbic IBTC.

6. FGN Bonds

Federal Government of Nigeria (FGN) bonds are a low-risk investment option suitable for individuals looking for steady and guaranteed returns. These bonds are backed by the Nigerian government, making them one of the safest ways to grow your money.

For instance, January 2025’s Offer includes a Two-Year FGN Savings Bond maturing on 22 January 2027 with a 17.235% annual interest rate (18.381% effective yield) and a Three-Year FGN Savings Bond maturing on 22 January 2028 with an 18.235% annual interest rate (19.52% effective yield). You can buy one unit for N1,000 with a minimum investment of N5,000. Interest is paid every three months (April, July, October and January) and your full bond is returned in one payment when the bond matures.

How to Invest

If you’re looking for guaranteed returns, allocate a portion of your monthly savings (e.g., N10k – N20k) to FGN bonds. They provide stability and predictable income, making them a valuable addition to your portfolio. You can buy FGN bonds through licensed broker-dealers on the FMDQ OTC trading platform or through Stanbic IBTC Stockbrokers on The Nigerian Stock Exchange (NSE).

What to Look Out for When Investing

Risk Tolerance

Understand your risk appetite. Choose stable options like mutual funds or FGN bonds if you’re risk-averse. While investing, watch out for get-rich-quick schemes that promise impressive returns without a real underlying asset. It’s always best to allow your money compound with regulated investment options.

Fees and Expenses

Compare transaction and management fees on platforms before investing.

Long-Term Thinking

Investments take time to grow. Avoid panic selling during market downturns.

Investing on a monthly income of N200k is possible with discipline and a clear strategy. By saving 20% of your income monthly, you can hit your investment goals by December. Start small and stay consistent to ensure steady growth!

Remember, time in the market is greater than timing the market.

Got questions or feedback? Leave your comments below.