Welcome to Monday Moneying, a rundown of the biggest financial stories shaping Nigeria, delivered straight to your inbox every Monday.

In this week’s episode…

Nigeria Drops to 66th in 2025 Global Startup Ecosystem

The Rundown

Nigeria has dropped two spots to rank 66th in StartupBlink’s 2025 Global Startup Ecosystem Index, and slipped to 4th place in Africa, reflecting the country’s lowest growth rate among the continent’s top 7 startup nations.

Despite the slide, Nigeria remains West Africa’s startup leader, with Abuja showing standout growth and Ilorin entering the global scene for the first time.

The Details

- Lagos remains Nigeria’s top startup hub but fell 6 places to 76th globally, while Abuja rose by over 50%, now ranked 399th—marking it as an emerging tech city to watch.

- Nigeria’s overall ecosystem is challenged by slow growth, infrastructure gaps, and low purchasing power, despite fintech dominance and a population of over 200 million.

- Six Nigerian cities are in West Africa’s top 10 and the global top 1,000, but most lost ground in global rankings.

- Government and private interventions—like the Startup Act, Seed Fund, and public-private partnerships—aim to support and sustain innovation.

- While StartupBlink ranked Nigeria 66th, a separate report by Dealroom.co tagged Lagos as one of the fastest-growing startup ecosystems globally, offering a more optimistic outlook.

Glovo Drives Over ₦71 Billion in Revenue for Nigerian Partners Since 2021

The Rundown

Nigeria’s food delivery and quick commerce sector is booming, with platforms like Glovo and Chowdeck generating billions in revenue for local vendors while digitising food access across major cities. Glovo alone has powered over ₦71 billion in revenue since 2021, while Chowdeck vendors like Amoke Oge and Korede Spaghetti are hitting billion-naira sales milestones.

The Details

- Glovo has facilitated ₦71 billion in revenue for Nigerian partners since its launch in 2021 and operates in 11 cities, with 70% of activity centered in Lagos.

- Chowdeck has enabled over ₦30 billion in delivery value, with over 1 million users, 3,000+ vendors, and 10,000+ riders across 8 states.

- Vendor highlights include Amoke Oge with 500,000+ deliveries (₦2.3 billion revenue) and Korede Spaghetti crossing ₦1 billion in sales.

- Glovo’s GMV grew 76% in 2024, while digital payments surged—cash use dropped from 88% in 2021 to 39%.

- Other players like Foodcourt, Bolt Food, HeyFood, UrbanEats, MANO, and Foodelo are also fueling sector growth, with riders earning ₦15k–₦25k daily, showing the sector’s rising economic impact.

Access Bank Acquires National Bank of Kenya to Deepen East Africa Presence

The Rundown

Access Bank has acquired the National Bank of Kenya (NBK) to boost its presence in East Africa and deepen its footprint in Kenya’s corporate, retail, and digital banking space. The move strengthens Access Bank’s regional strategy and marks another step in its pan-African expansion.

The Details

- Access Bank’s acquisition of NBK was finalized after regulatory approvals from Kenya’s Central Bank and National Treasury in April 2025.

- The deal combines NBK’s local expertise with Access Bank’s global reach, positioning the group for stronger service delivery in Kenya.

- Some NBK assets and liabilities were transferred to KCB Bank Kenya, ensuring a seamless transition and financial stability.

- Access Bank now operates in over a dozen African countries and maintains a global presence in the UK, UAE, China, Lebanon, and India.

- The acquisition reinforces Access Bank’s ambition to lead sustainable, inclusive banking across East Africa, leveraging innovation and regional partnerships.

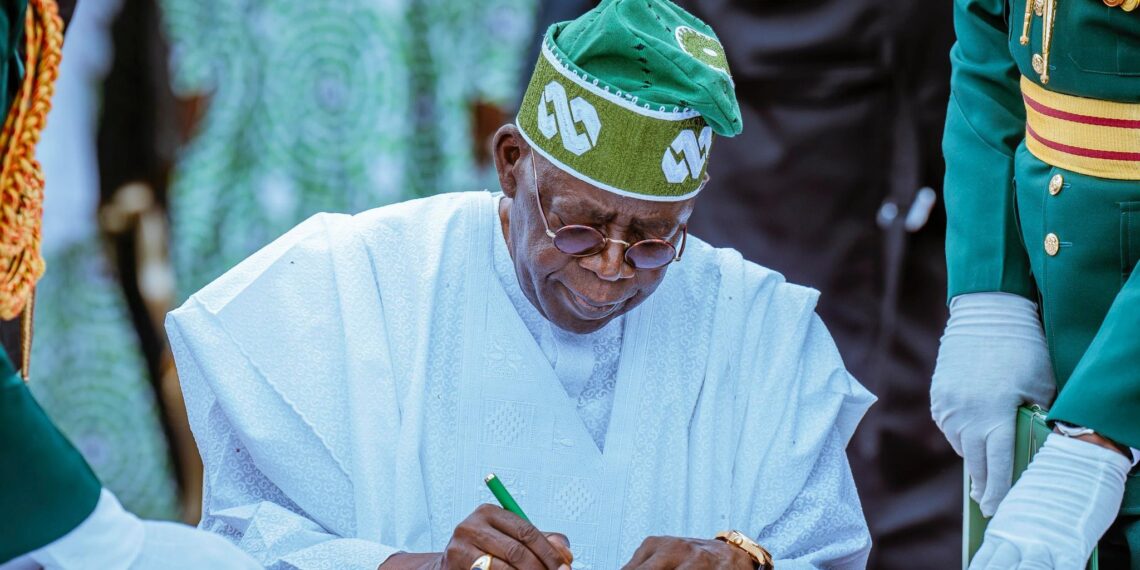

New Executive Order Targets Cost Cuts, Investment Surge in Oil & Gas Sector

The Rundown

President Tinubu has signed a new Executive Order to cut costs and boost investor confidence in Nigeria’s oil and gas sector. The 2025 Order introduces performance-based tax incentives for upstream operators who meet cost-efficiency benchmarks, aiming to drive more revenue and attract global investment.

The Details

- The Upstream Petroleum Operations Cost Efficiency Incentives Order (2025) rewards companies that achieve measurable cost savings based on terrain-specific benchmarks.

- Tax credits will be capped at 20% of a company’s annual tax liability, ensuring both investor rewards and fiscal discipline.

- The benchmarks will be published annually by the Nigerian Upstream Petroleum Regulatory Commission (NUPRC).

- The Special Adviser on Energy, Olu Verheijen, will lead inter-agency coordination to ensure smooth implementation and alignment across institutions.

- So far in 2025, rig counts are up 400% compared to 2021, and over $8 billion in new investments have been committed to Nigeria’s oil and gas sector.

- This Order builds on Tinubu’s 2024 reforms which included three other Executive Orders aimed at improving fiscal terms, shortening project timelines, and aligning local content rules with global standards

Tinubu Launches National Credit Guarantee Company to Boost Business Access to Loans

The Rundown

President Tinubu has launched the National Credit Guarantee Company (NCGC) with ₦100 billion in backing to make it easier for MSMEs, manufacturers, and even consumers to access loans. Former House Speaker Yakubu Dogara will chair the board, while Bonaventure Okhaimo has been named MD/CEO.

The Details

- NCGC aims to de-risk lending and boost credit access for MSMEs, manufacturers, and consumers.

- ₦100 billion startup capital comes from MOFI, NSIA, BOI, and CrediCorp.

- Board chaired by Yakubu Dogara; Bonaventure Okhaimo is MD/CEO.

- Supported by the World Bank with technical expertise.

- Ties into Tinubu’s push for inclusive growth and credit reform, especially for women and youth.