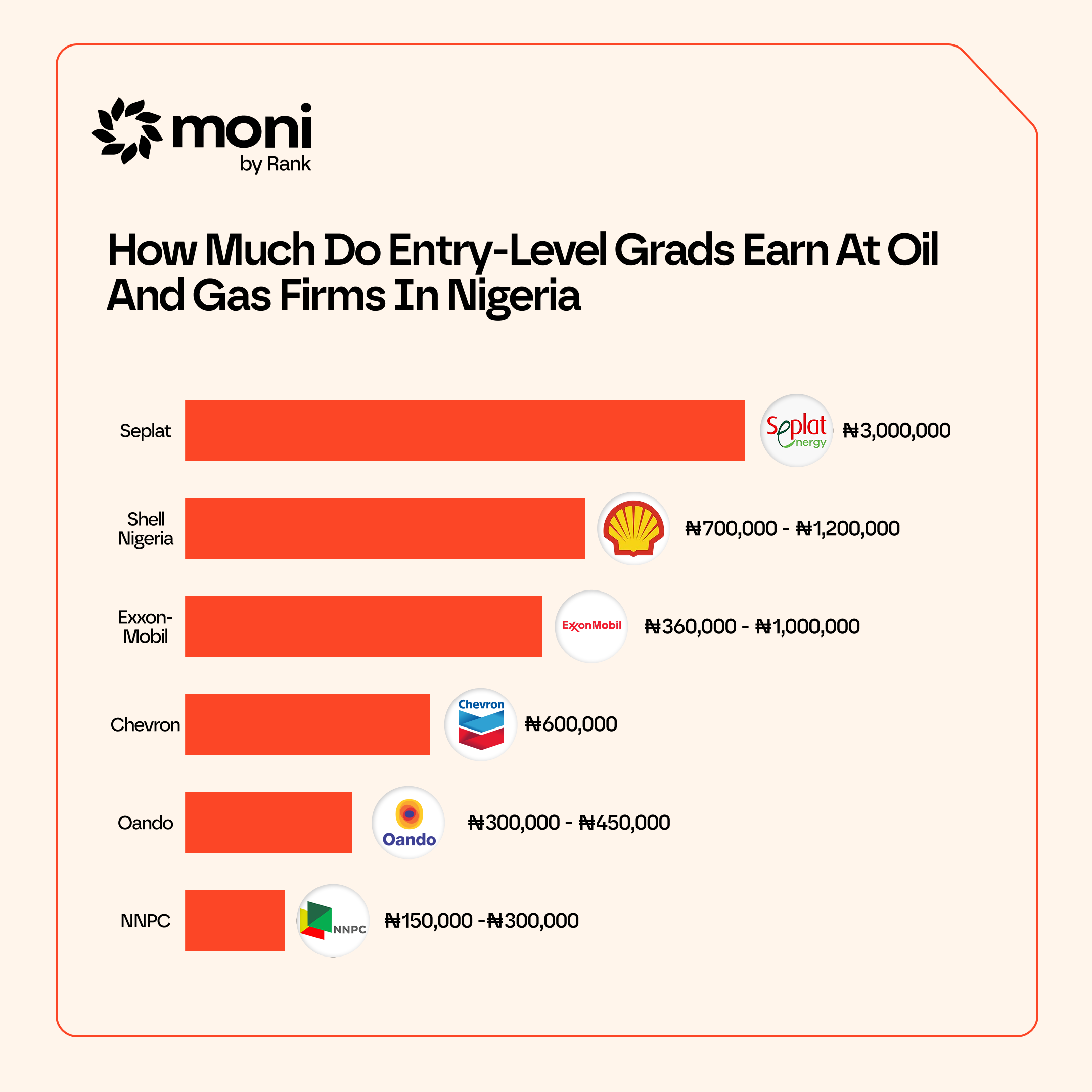

Dangote Refinery Set to Distribute Petrol and Diesel Nationwide, Deploys 4,000 CNG Tankers

The Rundown

Dangote Petroleum Refinery will begin nationwide distribution of petrol and diesel on August 15, 2025, aiming to transform Nigeria’s fuel supply chain. The initiative includes the deployment of 4,000 CNG-powered tankers, free logistics support, and a credit scheme for bulk buyers—all designed to improve fuel access, cut costs, and boost economic growth.

The Details

- Nationwide distribution of PMS and diesel kicks off on August 15, 2025, with direct sales to marketers, manufacturers, and large-scale users.

- 4,000 CNG-powered tankers and mini distribution hubs will deliver fuel across the country, with free logistics for registered dealers and businesses.

- The initiative aims to revive inactive petrol stations, cut operational costs, support SMEs, and stimulate job creation—especially in rural areas.

- Bulk buyers purchasing 500,000 litres can access an extra 500,000 litres on credit, repayable in two weeks with a valid bank guarantee.

- The company acknowledged the Naira-for-Crude scheme’s role in helping stabilise supply amid global volatility, reaffirming its commitment to affordable, sustainable energy.

Middle East Tensions Could Spike Fuel Prices in Nigeria, Analysts Warn

_(1).jpeg)

The Rundown

Rising tensions in the Middle East, following Israel’s airstrikes on Iranian nuclear facilities, have caused a sharp spike in global oil prices—posing a fresh threat to fuel costs in Nigeria. Analysts warn that escalating conflict, combined with Nigeria’s volatile exchange rate, could trigger another round of fuel price hikes and inflationary pressure.

The Details

- Brent crude surged by up to 13%, its steepest intraday gain since March 2022, before settling at a 7.6% increase.

- Experts say Nigeria could face higher landing costs and ex-depot prices, which may ultimately hit consumers at the pump.

- The spike followed Israeli airstrikes on key Iranian nuclear and military sites, escalating tensions between the two nations.

- Analysts highlight Nigeria’s unstable exchange rate as a compounding risk that could intensify the local impact of global oil shocks.

- While rising oil prices may boost government revenue, economists urge careful, frugal management to avoid worsening public hardship.

Nigeria Risks Losing $10M World Bank Grant Over Delayed Budget Reforms and Audit Gaps

.jpeg) The Rundown

The Rundown

Nigeria risks losing $10 million in World Bank funding under the Fiscal Governance and Institutions Project (FGIP) due to poor audit standards, delayed reforms, and slow implementation of critical financial infrastructure. The funds are part of a $103 million IDA-backed initiative to strengthen fiscal governance.

The Details

- At-Risk Funding: $10 million may be forfeited by June 30, 2025, due to unmet project goals and failed audit assessments.

- Audit Failures: Revenue audits for FIRS and NCS from 2018–2021 didn’t meet international standards, resulting in a failing review.

- Cancelled Funds: Nigeria has requested cancellation of $0.9M (unused technical assistance) and $9.5M tied to unachievable milestones—including $4M for failed audit improvements.

- What’s Next: Deeper governance reforms, stronger oversight, and timely execution are critical if Nigeria wants to maximize international funding and strengthen its fiscal resilience.

Nigeria and Angola to Drive Africa’s Energy Future with 90% Refining Capacity Boost

The Rundown

Nigeria and Angola are set to lead Africa’s drive toward energy security, as the continent’s refining capacity could rise to meet 90% of fuel demand—up from just 45% last year. A new AFC report highlights the pivotal role of Nigeria’s Dangote Refinery and calls for over $16 billion in refinery upgrades and new infrastructure to reduce reliance on fuel imports.

The Details

- If fully utilized, Africa’s refining capacity could supply up to 90% of the continent’s fuel needs, a massive leap from 45% in 2023.

- The AFC identifies both countries as emerging energy hubs, with the Dangote Refinery playing a central role in reshaping fuel supply on the continent.

- Over $16 billion is required to modernize existing refineries and develop new ones to meet clean fuel standards and rising demand.

- Import Dependence: In 2023, 55% of Africa’s fuel was imported. Full capacity utilization could reduce this to just 10%, transforming energy security across the continent.

- The report urges investment in pipelines, railways, and port infrastructure, emphasizing the need for resilient systems to support long-term energy independence.

China to Scrap Tariffs on African Imports in Landmark Trade Shift

.jpeg)

The Rundown

China has announced it will scrap all tariffs on imports from African countries with which it has diplomatic ties—offering zero-tariff treatment across 100% of tariff lines. The move signals a major policy shift and strengthens Beijing’s position as a preferred trade partner for Africa amid rising global trade tensions.

The Details

- All 53 African countries with diplomatic relations with China will now enjoy full zero-tariff treatment across all product categories.

- This builds on earlier efforts that limited the benefit to only the least-developed African nations, now covering all eligible countries.

- The decision is part of China’s broader effort to deepen economic ties with Africa as it navigates a prolonged trade war with the U.S.

- Nigeria’s foreign minister welcomed the move and advocated for expanded access to boost exports of agricultural goods and minerals.

- With uncertainty over U.S. trade policies like AGOA, China’s stable trade stance is attracting African nations seeking predictable partnerships.

.jpeg)