TL;DR: What If You Invested N1M in January 2025?

Here’s how much your N1 million would have grown by mid-year if you had invested in any of these:

- Moni Reserve (Low Risk):

N1M → N1.23M by Dec 2025 (23% return)

- Top ETFs (Medium Risk):

Up to 51.46% growth

N1M → N1.51M

- Dollar Savings (Low/Medium Risk):

8% + FX gains

N1M → Up to N1.2M

- Stock Market (High Risk):

Some stocks doubled or tripled

N1M → N2M – N3M+

- Mutual Funds (Balanced Risk):

7.5% – 38% returns

N1M → N1.075M – N1.38M

- FGN Bonds (Low Risk):

18.3% – 19.5%

N1M → N1.183M – N1.195M

- Gold:

Up to 26% in H1 2025

N1M → N1.26M

- Treasury Bills (Low Risk, Mid Tenor):

19% average return in H1

N1M → N1.19M

- Crypto – Bitcoin (High Risk):

19% return in H1

N1M → N1.19M

- Luxury Real Estate:

High appreciation + premium rental income in top locations

N1M → Part ownership or deposit for high-yield property

We know you’ve seen all the hype — stocks that doubled or even 4x’d investor profits in the first half of 2025. But what’s more exciting is that H2 2025 is still ripe with opportunity. If you have N1 Million (or even N500k or N200k) sitting idle, this is your sign to move.

The big question is: where should you put your money now to grow it before December 2025?

We’ve broken down the best-performing (and still promising) investment options — across savings plans, stocks, ETFs, dollar accounts, bonds, and mutual funds — with real examples and platforms to help you start. Let’s go!

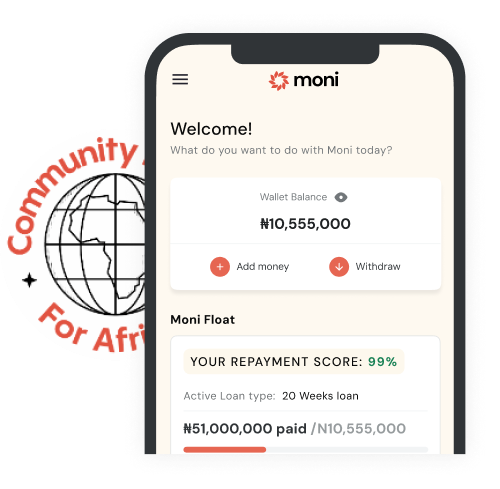

1. Earn up to 23% pa with Moni Reserve (Low Risk)

A High-Yield Savings Plan is one of the safest ways to grow your cash, especially if you want liquidity and low risk. Moni recently upped its SafeBox interest rate to 23% per annum, making it one of the highest-yielding saving products on the market.

- Invested N1M in July = N1.23M by December 2025

- Invested N500k = N615,000

- Invested N200k = N246,000

Best for: you if you’re a low-risk saver, emergency fund builder, or you’re new to investing.

Create a Moni Reserve plan and automate your savings directly from your bank. What’s more, Moni is currently running a Netflix promo

2. Earn up to 51% with ETFs (Exchange Traded Funds):

ETFs are one of the easiest ways to start investing without needing to pick individual stocks. Think of them like a basket that holds many investments (like bonds, stocks, or even gold), so you don’t put all your eggs in one basket.

In Nigeria, some ETFs have delivered solid returns so far in 2025:

Vetiva S&P Nigeria Sovereign Bond ETF (VSPBONDETF): This fund has grown by 51.46% as of June 2025. It invests mainly in FGN bonds, so it’s a great option if you want steady growth from government-backed assets but still want to benefit from market performance.

Vetiva Consumer Goods ETF (VETGOODS): This one has returned 46.51% so far in 2025. It gives you exposure to top Nigerian consumer brands — companies in food, drinks, and tobacco like Nestlé, Dangote Sugar, and Nigerian Breweries. If you want to invest in everyday Nigerian products and the companies behind them, this is a great pick.

NewGold ETF (NEWGOLD): This gold-focused fund has returned 30% so far in 2025. It tracks the price of gold and is listed in multiple African countries. It’s ideal if you want to protect your money against inflation or currency depreciation, since gold usually holds its value even in tough times.

How to Get Started: To invest in any of these ETFs, open an account on platforms like Meritrade by Meristem or speak to your stockbroker. You can start small and build over time.

3. Save in Dollars – Hedge & Grow (Up to 8% Return + FX Upside)

Dollar savings help you preserve value and earn returns even when the Naira dips. In 2024, USD-denominated savings offered up to 8% returns, and in 2025, although the naira has strengthened in H2 2025, saving in dollars is still a smart move.

Invested N1M (approx. $670) at 8% = N1.08M + FX gain

(Your pot could grow up to N1.2M depending on the Naira’s movement)

How to start: Contact your Moni account manager or email hello@heymoni.com to get started.

4. Double or Triple Your Money in the Nigerian Stock Market (High Risk, High Reward)

Stocks were the star of 2024 — and 2025 is off to a strong start too.

H1 2025 saw huge gains across certain penny and blue-chip stocks like Betaglass and Honeywell. It’s not too late to ride the momentum. These are the stocks we think you should be considering for H2:

Dangote Sugar – A top player in Nigeria’s consumer goods sector, with continued strong performance in 2025. Returns for H1 2025: The Dangote Sugar stock appreciated by

GT Bank (GTCO) – Known for consistent dividends and solid financials, GTCO remains a blue-chip favourite among retail and institutional investors. The GTCO bank stock appreciated by +42.54% in H1 2025.

Beta Glass – A heavyweight stock with strong potential tied to infrastructure and housing demand. Returns for H1 2025: The Betaglass stock appreciated by +414.56%.

Okomu Oil – With its steady export performance and strong demand in the agriculture sector, Okomu remains a reliable performer.

If you’re looking to take bigger (but calculated) risks for potentially higher rewards, penny stocks are worth a look. These are low-priced stocks that can deliver impressive returns — especially when the companies behind them start showing growth or get investor attention. SCOA Nigeria, RT Briscoe and The Initiates Plc are new penny stock picks worth watching in the second half of 2025.

Just remember, as with all stock investments, it’s important to do your own research, watch market trends, and diversify your holdings.

How to start: Use stock trading platforms like Chaka, Trove, Bamboo, or Meritrade. Look for stocks with strong earnings and growth outlooks.

5. Earn 7.5% – 38% with Mutual Funds (Balanced Risk)

Mutual funds are still a solid choice if you want diversification, pro management, and decent returns. 2024 returns ranged between 7.5% and 38%, with standout funds like Halo Equity Fund delivering an 87% YTD return.

Invested N1M = N1.075M – N1.38M (or higher)

Invested N500k = N537.5k – N690k

Invested N200k = N215k – N276k

Where to invest: Platforms like Stanbic IBTC or Meristem offer easy entry into mutual funds starting from as low as N5,000.

6. Gold – Up to 26% Returns in H1 2025

Gold has quietly outperformed many other assets this year, delivering up to 26% returns in the first half of 2025, according to Economic Times. It remains a solid hedge against inflation and currency depreciation especially for Nigerian investors seeking global diversification.

Invested N1M = Up to N1.26M

This growth is driven by rising global uncertainty and central bank demand, making gold a steady performer regardless of market turbulence.

Best for: conservative investors looking to preserve value over time or hedge against currency risk.

How to Start:

You can invest in gold via NewGold ETF, buy physical gold through verified dealers, or explore gold-backed digital assets available on global exchanges.

7. Treasury Bills (T-Bills) – Average 19% Return in H1 2025

If you’re looking for short-term, low-risk gains, Treasury Bills (T-Bills) are still a top pick. With an average yield of 19% in H1 2025, T-Bills outperform most traditional savings accounts, and they’re backed by the Federal Government of Nigeria.

Invested N1M = N1.19M in 12 months

You can choose tenors of 91, 182, or 364 days depending on your liquidity needs.

Best for: risk-averse investors who want steady growth and quick maturity.

How to Start:

Buy directly through your bank, stockbroker, or investment platforms like Stanbic IBTC and CSL Stockbrokers. Here’s a quick guide to get you started.

8. Crypto (Bitcoin) – 19% Growth in H1 2025 (High Risk, High Reward)

Bitcoin stayed strong in 2025, posting 19% gains in H1, thanks to rising institutional adoption and tech innovation in the blockchain space (CryptoDnes). While it’s volatile, crypto remains an exciting part of any high-risk portfolio — especially for younger or tech-savvy investors.

Invested N1M = N1.19M

And with strong sentiment for the second half of 2025, there may still be upside ahead.

Best for: risk-tolerant investors who want fast growth and exposure to emerging digital finance trends.

How to Start:

Use platforms like Binance, Quidax, or Bundle to buy Bitcoin and other cryptocurrencies. Start small and never invest more than you can afford to lose.

9. Luxury Real Estate – Premium Properties Are Outperforming

Beyond traditional rental properties, luxury real estate in Lagos is delivering impressive returns. According to Qace Homes’ Lagos H1 2025 report, demand is surging for high-end apartments, especially in Ikoyi, Victoria Island, and Banana Island.

Rental yields and appreciation on premium properties are outpacing regular residential real estate — thanks to high-net-worth individuals, expatriate demand, and the rise of branded short-let developments.

Best for: long-term investors with larger budgets looking for stable growth, prestige, and high passive income potential.

How to Start:

Connect with developers or luxury brokers, or explore co-investment schemes that let you own a fraction of high-value property without the full capital requirement.