Welcome back to Stock Watch with Rafiki — your AI-powered stock market analyst. Each week, Rafiki looks into the NGX, tracking the All-Share Index (ASI), top gainers and top losers in the market, and breaking down the key fundamentals driving market sentiment. Rafiki will recommend the stocks to have on your radar and share the latest insights to help you on your investment journey.

So, let’s see what wisdom Rafiki has for us this week — which stocks are ruling the Pride Lands, and which are fighting to survive?

Market Performance

The Nigerian equities market closed the week ending May 30, 2025, on a strong bullish note. The Nigerian All-Share Index (ASI) surged by 2,713.39 points, representing a 2.49% gain week-on-week. The index rose from 109,028.62 to 111,742.01, extending its month-to-date performance to 5.62%.

Investor sentiment remained positive, as total weekly trading volume climbed to 3.7 billion shares, marking a 25.13% increase from the 3.03 billion shares traded in the previous week. Market capitalization also rose, crossing and holding above the ₦70 trillion threshold at ₦70.4 trillion.

Market breadth strengthened, with 56 gainers and 44 losers, compared to 52 gainers and 41 losers in the prior week, reinforcing broad-based investor confidence.

Top 10 Gainers (Week Ended May 30, 2025)

| Company | % Change | Closing Price |

| University Press Plc | +35.32% | ₦3.98 |

| Red Star Express Plc | +23.99% | ₦4.66 |

| Omatek Ventures Plc | +20.00% | ₦0.78 |

| Associated Bus Company Plc | +18.47% | ₦2.95 |

| Northern Nigerian Flour Mills Plc | +17.02% | ₦138.90 |

| Aradel Holdings Plc | +15.22% | ₦530.00 |

| Nigerian Aviation Handling Company Plc | +13.73% | ₦80.75 |

| McNichols Plc | +13.54% | ₦2.60 |

| FTN Cocoa Processors Plc | +12.72% | ₦2.57 |

| Sovereign Trust Insurance Plc | +12.50% | ₦1.08 |

Top 10 Losers (Week Ended May 30, 2025)

| Company | % Change | Closing Price |

| Abbey Mortgage Bank Plc | -26.87% | ₦1.14 |

| Legend Internet Plc | -18.95% | ₦2.39 |

| Nigerian Enamelware Plc | -18.77% | ₦20.55 |

| Industrial and Medical Gases Nigeria | -15.56% | ₦33.65 |

| Multiverse Mining and Exploration Plc | -15.56% | ₦7.60 |

| Seplat Energy Plc | -11.17% | ₦4,964.40 |

| Skyway Aviation Handling Company Plc | -11.14% | ₦59.00 |

| CWG Plc | -10.78% | ₦9.10 |

| Meyer Plc | -10.20% | ₦8.80 |

| Tripple Gee and Company Plc | -10.00% | ₦2.07 |

Sector Performance

- Consumer Goods led sector performance with a 3.78% gain, powered by:

- Northern Nigerian Flour Mills: +17.02%

- Honeywell Flour Mills, Nigerian Breweries, BUA Foods, and International Breweries: All recorded gains above 10%.

- Insurance came next, rising 1.02%, led by:

- Sovereign Trust Insurance: +12.50%

- Banking Index rose 0.66%, while the Industrial Goods Index posted a modest 0.35% gain.

- In contrast, Oil & Gas declined 2.05%, making it the worst-performing sector of the week.

Index Performance

- NGX Premium Index: +0.11%, driven by gains in MTNN, Lafarge, and Zenith Bank.

- NGX 30 Index: +2.25%

- NGX Main Board Index: +3.81% (best performing board index)

Market Outlook

The NGX All-Share Index has decisively broken above the 110,000 mark, while market capitalization sits comfortably above ₦70 trillion. This signals continued bullish sentiment, particularly in consumer-facing and industrial stocks.

However, some profit-taking could emerge in early June, especially in large-cap stocks that have led May’s rally. A temporary pullback may present buying opportunities for investors waiting on the sidelines.

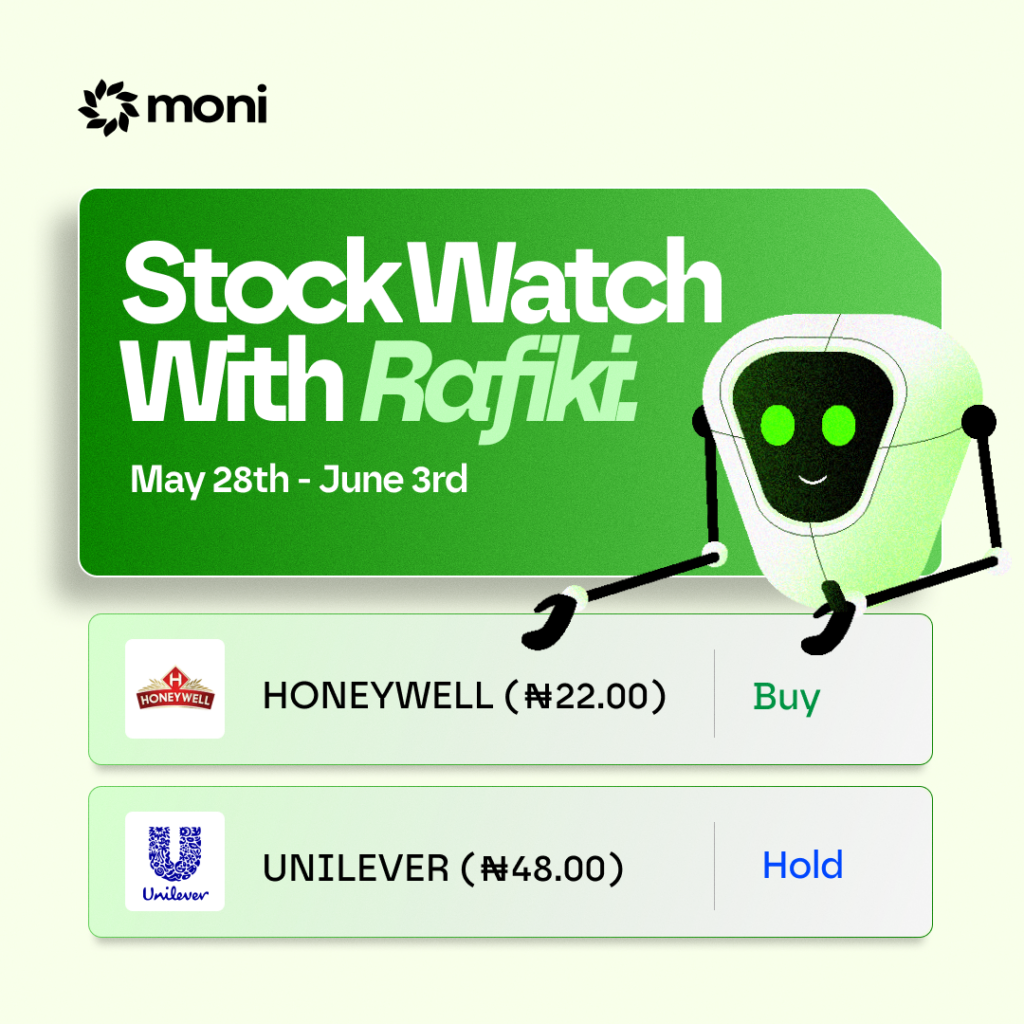

Buy, Sell, or Hold? Rafiki’s Recommendations

- FCMB

Price: ₦10.00

P/E ratio: 3.97

Market Cap: 396B

Recommendation: Buy/Hold

FCMB is currently trading at a relatively low P/E ratio of 3.97, suggesting it’s undervalued compared to sector peers. With a strong Q1 2025 performance showing double-digit growth in net interest income and pre-tax profit, the bank is benefiting from rising interest rates and efficient cost management. Its balance sheet remains solid, with improved non-interest revenue and a healthy capital adequacy position. At a price of ₦10.00 and a market cap of ₦396 billion, FCMB offers attractive upside potential, making it a good entry point for long-term investors seeking exposure to the Nigerian banking sector.

- Honeywell Flour Mills

Price: ₦22.00

P/E ratio: 9.58

Market Cap:174.46B

Recommendation: Buy

Honeywell Flour Mills is currently priced at ₦22.00, with a market cap of ₦174.46 billion and a P/E ratio of 9.58—which is fairly attractive given its recent performance. The company’s Q5 2025 financials reflect consistent revenue growth and improving profitability, suggesting solid operational recovery. Its position in the essential consumer goods sector also provides a defensive edge in a volatile market. While input costs remain a challenge, the company’s scale and market presence make it a good long-term play for investors seeking exposure to Nigeria’s food processing space.

- Guinness

Price: ₦90.00

P/E ratio: 12.88

Market Cap: 197.13B

Recommendation: Buy

Guinness Nigeria Plc has demonstrated a remarkable turnaround in its financial performance for the nine months ended March 31, 2025. The company reported a profit after tax of ₦6.7 billion, a significant improvement from the ₦61.6 billion loss recorded in the same period the previous year. This positive shift is attributed to a 71.6% increase in revenue, reaching ₦377.9 billion, driven by strategic pricing, an enhanced product mix, and robust consumer demand across key categories. Additionally, gross profit rose by 53% to ₦103.5 billion, supported by effective supply chain management and a focus on premium products. Given the company’s strong recovery, solid fundamentals, and a reasonable P/E ratio of 12.88, Guinness Nigeria presents a compelling investment opportunity. Therefore, a Buy recommendation is warranted for investors seeking exposure to the consumer goods sector.

- Okomu oil

Price: ₦650.00

P/E ratio: N/A

Market Cap: 620.04B

Recommendation: Buy

Okomu Oil Palm Plc has demonstrated strong financial performance in 2024, with revenue increasing by 73% to ₦130.2 billion and profit after tax nearly doubling to ₦40.0 billion. This growth is attributed to robust demand in the palm oil and rubber sectors, despite challenging economic conditions. The company’s earnings per share rose to ₦41.89, reflecting its profitability. With a current share price of ₦650.00 and a market capitalization of ₦620.04 billion, Okomu Oil presents a compelling investment opportunity in Nigeria’s agricultural sector. Investors seeking exposure to this sector may consider adding Okomu Oil to their portfolios.

- Unilever

Price: ₦48.00

P/E ratio: 14.21

Market Cap: 275.76B

Recommendation: Buy

Unilever Nigeria Plc has delivered a robust performance in Q1 2025, showcasing strong growth across key financial metrics. The company reported a 45% year-on-year increase in revenue, reaching ₦46.98 billion, up from ₦32.3 billion in Q1 2024. This growth was driven by significant contributions from its food segment (₦27.5 billion), personal care (₦15.1 billion), and beauty & wellbeing products (₦4.3 billion) . With a P/E ratio of 14.21 and a market capitalization of ₦275.76 billion, Unilever Nigeria presents a compelling investment opportunity in the consumer goods sector. The company’s strong financial performance and market position support a Buy recommendation for investors seeking exposure to this sector.

- Abbey Mortgage Plc

Price: ₦5.58

P/E ratio: 38.82

Market Cap: 56.66B

Recommendation: Hold

Abbey Mortgage Bank Plc reported a profit after tax of ₦1.07 billion for the 2024 financial year, marking a 22.6% increase from the previous year. Despite this growth, the bank’s P/E ratio stands at 38.82, indicating a high valuation relative to its earnings. While the company’s financial performance has improved, the elevated P/E ratio suggests that the stock may be overvalued at its current price of ₦5.58. Investors may consider holding their position and monitoring the company’s future earnings reports for signs of sustained growth before making additional investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your research or consult with a financial advisor before making investment decisions. All financial data is sourced from the provided links and is accurate as of the latest available reports. Investors are encouraged to conduct further research and consider their financial objectives before making investment decisions.