Welcome to Monday Moneying, a rundown of the biggest financial stories shaping Nigeria, delivered straight to your inbox every Monday.

In this week’s episode…

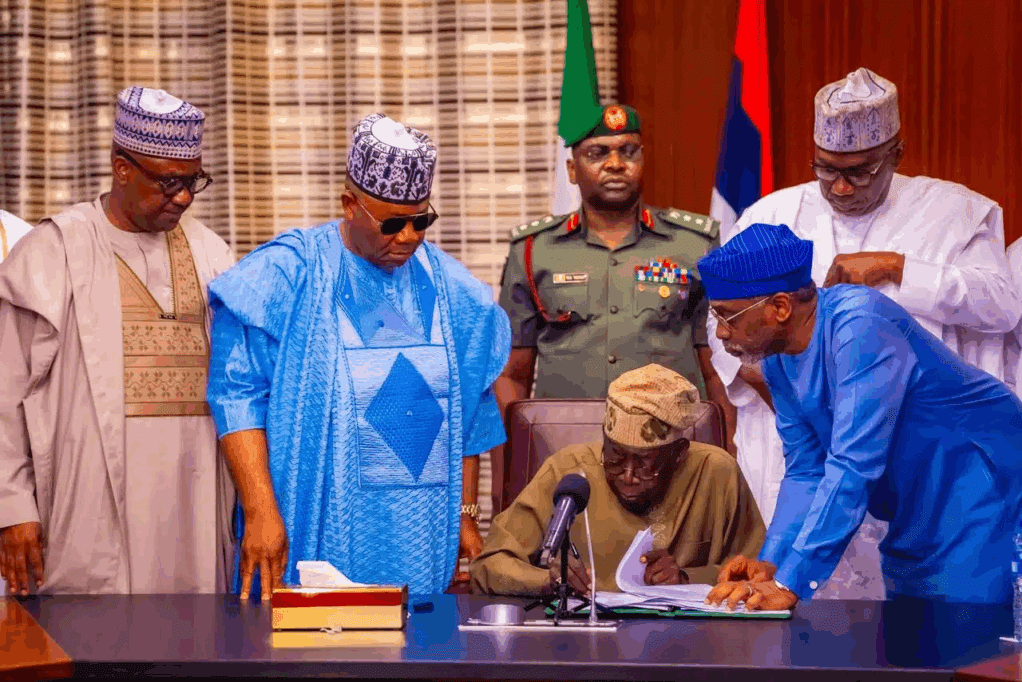

President Tinubu signs tax reform bills into law, brings key changes to Businesses and Employees Tax in Nigeria

The Rundown

President Bola Tinubu has signed into law four tax reform bills on key areas of Nigeria’s fiscal and revenue framework. The four bills include: the Nigeria Tax Bill, the Nigeria Tax Administration Bill, the Nigeria Revenue Service (Establishment) Bill, and the Joint Revenue Board (Establishment) Bill. Here are what the new tax laws mean for you.

The Details

- Expanded Tax Exemptions for Small Businesses and Low-Income Earners: Businesses with annual revenue of ₦50 million or less are now exempt from Company Income Tax (CIT), doubling the previous threshold of ₦25 million. Additionally, individuals earning ₦83,000 per month (or ₦1 million annually) are no longer required to pay Pay-As-You-Earn (PAYE) tax, offering significant relief to microenterprises and low-income workers.

- Reduced Tax Burden for Middle-Income Earners: The reforms introduce new personal reliefs, resulting in lower tax rates for individuals earning up to ₦1.7 million per month. This measure is aimed at easing the financial burden on Nigeria’s middle class and incentivizing formal employment.

- Remote Workers and Freelancers Now Required to Pay Tax: Nigerians residing in the country but earning foreign income—such as freelancers, consultants, or remote employees—are now obligated to register with their respective state tax authorities, declare their income in naira, and fulfill tax obligations like other local earners. The Federal Inland Revenue Service (FIRS) and Central Bank of Nigeria (CBN) are also enhancing tracking mechanisms for foreign remittances via platforms such as Payoneer, Wise, and Barter.

- Significant VAT Exemptions on Essential Goods and Services: Value-Added Tax (VAT) will no longer apply to essential items such as basic groceries, baby products, school fees, medical expenses, and electricity. This reform is designed to support low-income households by reducing the cost of living and improving access to basic needs.

- Tax Relief on Severance and Retirement Benefits: Individuals who are laid off or retiring will now enjoy a tax exemption on the first ₦50 million received as severance or retirement benefits. This provision offers a financial cushion during periods of transition and economic uncertainty.

- A Shift Towards Fairer, Digital-First Tax Administration: The reforms aim to streamline tax collection by consolidating processes into a single digital platform, reducing the number of arbitrary levies, and simplifying compliance for individuals and businesses. A new, autonomous Nigeria Revenue Service (NRS) will replace the FIRS, complemented by the creation of a Joint Revenue Board to prevent double taxation by federal and state authorities.

- Strengthened Taxpayer Rights and Dispute Resolution Mechanisms: To enhance accountability, the reforms establish a Tax Appeal Tribunal and a Tax Ombudsman. These bodies will provide taxpayers with avenues to challenge erroneous assessments or administrative injustices, ensuring greater transparency and fairness in the tax system.

Foreign Investment in Nigeria Drops 19% in Q1 2025, Hits $250 Million – CBN Report

.jpeg)

The Rundown

Nigeria’s financial account weakened in Q1 2025, with capital flight intensifying amid a sharp $10.6 billion reversal in portfolio investments. Despite a resilient trade surplus and rising exports, the overall balance of payments swung into a $2.77 billion deficit, eroding external reserves. Persistent macroeconomic uncertainty, exchange rate volatility, and falling investor confidence continue to weigh on Nigeria’s external position.

The Details

- Capital Flight and Portfolio Reversals: Portfolio investments shifted from a $5.61 billion inflow in Q4 2024 to a $5.03 billion outflow in Q1 2025, reflecting fading appetite for Nigerian short-term assets; “other investments” and direct investment assets also posted significant declines.

- External Buffers Under Pressure: Foreign reserves fell from $40.19 billion in December 2024 to $37.82 billion in March 2025, following a $2.77 billion balance of payments deficit, compared to a $1.10 billion surplus the previous quarter.

- Current Account Holds Steady: A goods trade surplus of $4.16 billion and 9.79% export growth—driven by gas, electricity, and non-oil exports—helped maintain a current account surplus of $3.73 billion, cushioning the broader external weakness.

- Rising Deficits Elsewhere: The services account posted a wider net deficit of $3.69 billion due to higher travel and business service spending, while diaspora remittances and foreign aid both declined sharply.

- Investor Confidence Remains Fragile: Factors such as exchange rate instability, high inflation, and policy uncertainty continue to discourage capital inflows and fuel offshore diversification by Nigerian investors.

Nigeria’s Public Debt Soars to N149.39 Trillion, Up N27.72 Trillion from Q1 2024 – DMO

The Rundown

Nigeria’s total public debt surged to ₦149.39 trillion as of March 31, 2025—up 22.8% year-on-year—driven by new borrowings and a weaker naira amplifying external debt burdens. External debt rose sharply to ₦70.63 trillion, while domestic debt climbed to ₦78.76 trillion, highlighting continued fiscal reliance on both foreign and local funding. The shift in debt composition and mounting servicing costs raise fresh concerns over Nigeria’s long-term debt sustainability.

The Details

- Total Public Debt Nears ₦150 Trillion: Nigeria’s debt stock rose by ₦27.72 trillion year-on-year, with a ₦4.72 trillion increase recorded in Q1 2025 alone, reflecting both fresh borrowing and the impact of currency depreciation.

- External Debt Growth Accelerates: External debt climbed 26.1% year-on-year to ₦70.63 trillion ($45.98 billion), with the surge in naira terms largely driven by the naira’s decline rather than new foreign loans.

- Domestic Debt Continues Upward Trend: Domestic debt reached ₦78.76 trillion, a 20% rise from the previous year, with the Federal Government accounting for ₦74.89 trillion. However, state-level debt declined slightly, aided by stronger FAAC allocations.

- Debt Composition Shifts: As of Q1 2025, domestic debt made up 52.7% of the total, while external debt accounted for 47.3%, a slight shift from the previous year as external borrowing grows in prominence.

- Rising Debt Service Burden: Nigeria’s growing debt profile, particularly in foreign currency, raises fiscal sustainability concerns, especially as servicing costs eat up a substantial portion of government revenue.

FG Begins Interest-Free Credit Disbursement to Market Women in Abia Through CREDICORP

The Rundown

The Federal Government, via CREDICORP, has begun disbursing interest-free consumer credit to market women in Abia State as part of a nationwide rollout to boost financial inclusion and empower small-scale traders. Through a partnership with Sytiamo Technologies, the initiative offers up to ₦2 million in collateral-free credit to underserved communities, starting with 100,000 traders. The scheme aims to reach one million market women across Nigeria, supporting grassroots commerce and improving access to essential goods and services.

The Details

- Interest-Free Credit Rollout Begins in Abia: CREDICORP launched the disbursement phase of its interest-free consumer credit programme in Aba, targeting market women as part of efforts to support micro-entrepreneurs.

- Collateral-Free, Inclusive Access: Applicants only need a BVN, NIN, business address, passport photo, and a guarantor’s letter—no collateral required—to access loans of up to ₦2 million.

- Partnership-Led Implementation: CREDICORP operates through accredited intermediaries; Sytiamo Technologies is the first disbursement partner, leveraging its micro-lending experience and market relationships.

- Nationwide Ambition: Starting with 100,000 recipients, the programme aims to reach one million market women across Nigeria, beginning with traders due to their organisation and accessibility.

- Community Buy-In and Repayment Monitoring: Market leaders, such as those in Ariaria Main Market, have pledged to support loan repayment efforts, ensuring sustainability of the programme.

FG Launches National Flood Insurance Policy to Protect Citizens, Businesses from Climate Shocks

.jpeg)

The Rundown

The Federal Government has introduced a National Flood Insurance Policy (NFIP) to offer financial protection to individuals, businesses, and communities affected by recurring flood disasters across Nigeria. The policy marks a strategic shift from reactive disaster relief to proactive flood risk management, aiming to reduce pressure on public funds and enhance long-term resilience. It will feature structured implementation timelines, regulatory frameworks, and targeted support for high-risk regions such as agrarian communities near the River Benue and River Niger.

The Details

- A New Safety Net for Flood Victims: The NFIP is designed to cushion citizens, businesses, and local governments from the economic impact of seasonal flooding, offering dedicated insurance coverage rather than relying on post-disaster aid.

- Government-Led but Community-Focused: The Ministry of Environment will oversee implementation, with mechanisms for monitoring, accountability, and community-level delivery through inclusive financing and risk pooling models.

- Shift to Proactive Risk Management: The policy aligns with Section Four of the National Erosion and Flood Control Policy and promotes insurance as a preemptive tool for resilience rather than a reactive measure.

- Focus on Vulnerable Communities: With trillions of naira lost to floods over the years, the initiative targets high-risk zones—especially farming communities along major rivers—to prevent loss of livelihoods and deepen poverty cycles.

- Standalone Flood Coverage Emphasised: Officials stress the need for flood-specific insurance schemes, arguing that general insurance often fails to adequately cover flood-related damages.