Welcome to Monday Moneying, a rundown of the biggest financial stories shaping Nigeria, delivered every Monday.

In this week’s episode…

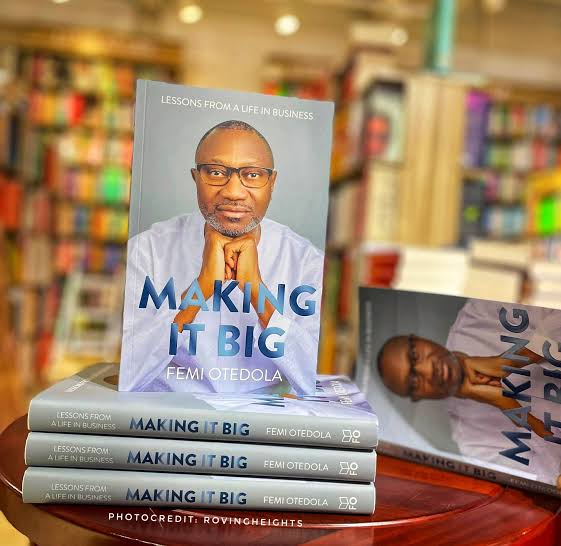

Femi Otedola’s book Making it big ranks no. 3 on Amazon Bestsellers

The Rundown

Femi Otedola’s new memoir, Making It Big, has climbed to No. 3 on Amazon’s bestseller list for Business Biographies and Memoirs just 48 hours after release. The 286-page book, launched on August 18, offers a candid look at the billionaire’s journey through challenges, breakthroughs, and lessons in business. Otedola shares his rise from running his father’s printing press in Lagos to building multi-billion naira ventures across oil, power, and finance.

The Details

- Otedola announced the Amazon milestone on X (formerly Twitter) with a poster confirming the ranking.

- The memoir covers personal setbacks, doubts, and guiding principles throughout his career.

- He recounts leaving school before completing his A Levels to join the family printing business in Surulere, Lagos.

- His early ventures included managing Impact Press and later founding Centre Force Ltd. in 1994 with ₦10 million.

- Otedola went on to lead Forte Oil, expand into Geregu Power Plc, and currently chairs First HoldCo Plc, where his investments total ₦320 billion in cash.

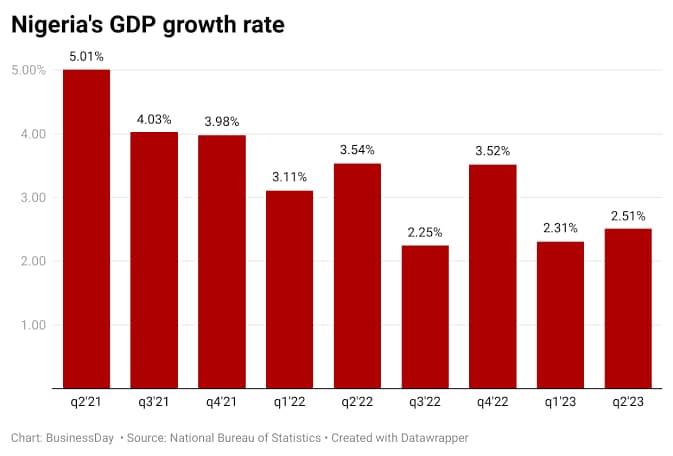

Nigeria’s GDP projected to expand in Q2 2025 on Rebasing, Stable FX and Strong business activity

The Rundown

Nigeria’s economy is projected to grow faster in Q2 2025, with analysts forecasting GDP expansion of 3.2%–3.9%, ahead of Q1’s 3.13% growth. The outlook reflects stronger non-oil sector performance, macroeconomic stability, and gains from the recent GDP rebasing. The official GDP report from the National Bureau of Statistics (NBS) is expected later this month.

The Details

- Forecasted Q2 2025 GDP growth: 3.2%–3.9%, stronger than both Q1 2025 and Q2 2024.

- Key drivers include financial services, telecoms, and industry, alongside broader non-oil expansion.

- Q1 2025 growth was supported by the services sector, offsetting oil sector weakness.

- Contributing factors: exchange rate stability and the recent GDP rebasing.

- Official figures from the NBS are due for release before the end of August 2025.

Apetu of Ipetumodu blames Covid-19 for $4.2M US fraud in court.

The Rundown

Oba Joseph Oloyede, the Apetu of Ipetumodu in Osun State, faces sentencing in the U.S. on August 26, 2025, after being convicted in a $4.2 million COVID-19 relief fraud. He admitted guilt but blamed financial hardship during the pandemic for his role in the scheme. The case has drawn global attention, tarnishing his royal legacy and leaving his throne vacant since 2024.

The Details

- Oloyede was arrested by the FBI and linked to the “Benefit Boys” fraud network.

- The fraud siphoned millions of dollars in U.S. pandemic relief funds intended for struggling families and businesses.

- The monarch has pleaded for leniency, citing pandemic-driven financial pressure.

- Legal experts say his chances are slim, as U.S. courts often give tough sentences in large-scale COVID-19 fraud cases.

- In Nigeria, the Apetu throne remains vacant since May 2024, with locals viewing the scandal as a major blow to Ipetumodu’s cultural heritage.

DBO on behalf of FGN announces N200 billion in bonds subscription by August 2025

The Rundown

The Federal Government, through the Debt Management Office (DMO), is offering N200 billion in bonds for subscription via auction on August 25, 2025, with settlement set for August 27. The issuance consists of two re-openings: a five-year FGN JUL 2030 bond and a seven-year 17.95% FGN JUN 2032 bond, each valued at N100 billion. This comes after the July auction, which raised N185.9 billion despite being oversubscribed, reflecting sustained investor interest in government debt.

The Details

- August offer: N200 billion split into N100bn 5-Year FGN JUL 2030 and N100bn 7-Year 17.95% FGN JUN 2032 re-openings.

- Minimum subscription: N5,000, with increments of N1,000, and maximum of N50 million per investor.

- Interest: determined by auction clearing yield, paid semi-annually; principal repaid in full at maturity.

- July 2025 auction: raised N185.9bn, with allotments of N13.43bn (2029 bond) and N172.5bn (2032 bond).

- July bonds priced below coupon rates, with marginal yields of 15.69% (2029) and 15.90% (2032), indicating declining yield expectations.

- Investors can subscribe via Primary Dealer Market Makers (PDMMs) including Access Bank, First Bank, Stanbic IBTC, GTBank, Zenith, UBA, and others.